Picture-Illustration: Intelligencer; Images: Amazon

Right here’s an experiment you’ll be able to run your self. Open up a class on Amazon — Electronics, Toys, House Backyard & Instruments, no matter — and scan the primary web page for a product listed with no apparent model, or maybe a semi-brand like IOCBYHZ, BANKKY, or KLAQQED. Check out the product photographs and outline, and observe the value. Subsequent, attempt to discover the product on Temu, the low cost app with the Tremendous Bowl advertisements, and verify how a lot it prices. Subsequent, attempt to discover it on AliExpress, the worldwide e-commerce subsidiary of the Chinese language Alibaba Group, or on TikTok Store. Lastly, you’ll be able to search for it on Alibaba correct, the place it is perhaps obtainable as effectively, shipped straight from China.

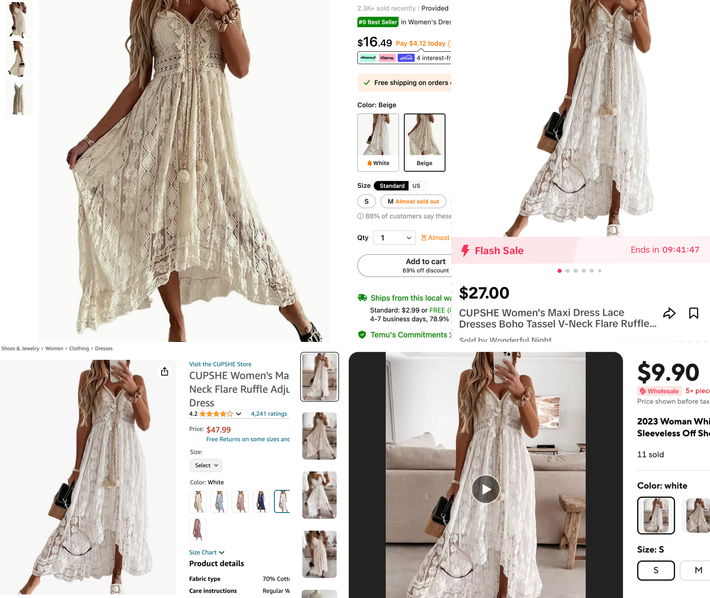

Generally, not all the time, however greater than you would possibly count on, this works. Take this gown from CUPSHE, listed on Amazon at $47.99, with greater than 4200 scores, largely constructive. On Temu, the place it additionally ships free of charge from a “native” (learn: home) warehouse, it’s listed as “Womens Informal Boho Lace Hem Floral V Neck Lengthy Seaside Gown Cocktail Social gathering Maxi Marriage ceremony Gown” and prices simply $16.49. On TikTok Store, it’s on Flash Sale with free delivery for $27 {dollars}. On AliExpress, it’s obtainable at a lot of costs from completely different sellers, for $9.90 with $9.60 delivery, or, on promotion, shipped free with an alleged 85.2% likelihood of arriving inside 14 days for $8.66.

Picture-Illustration: Intelligencer; Images: Temu, TikTok Store, Amazon, and AliExpress

I didn’t order these attire, so I can’t confirm that they’re precisely the identical or that one isn’t a rip-off of one other, nor do I do know sufficient about boho maxi attire to inform you if these are a rip-off of a design from outdoors the low cost e-commerce world.

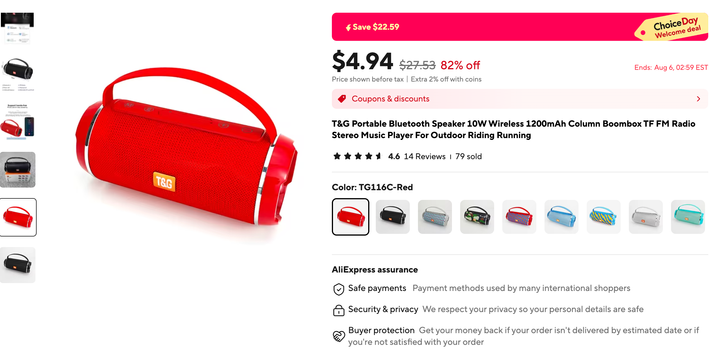

Picture: Amazon

However once more, this isn’t unusual. One well-liked speaker, for instance, branded as T&G, is $15.75 on Amazon, $8.38 on Temu, and $4.94 with free delivery on AliExpress. It’s clearly… impressed by well-liked audio system from 78-year-old firm JBL which additionally promote on Amazon, albeit for $89.95 on steep low cost.

Picture: AliExpress

The method works throughout classes: a pair of motorbike shorts goes from $19.99 to $11.77 to $2.30; a folding utility wagon goes from $95 to $38.99 (indistinguishable from the one our household bought on Amazon in 2023 for $110.59). Are these the very same merchandise? Perhaps, and in lots of circumstances most likely. It’s potential they’re constructed from the identical reference designs by completely different factories; in different circumstances, they is perhaps offered by the identical sellers on completely different platforms.

However for anybody prepared to take a while to comparison-shop throughout large on-line shops, it’s clear one thing is occurring: Amazon is turning into extra like Temu, TikTok Store, Shein, and AliExpress whereas Chinese language e-commerce platforms have gotten, in America a minimum of, extra like Amazon. The large shops are all promoting the identical brandless imports from China, typically at wildly completely different costs, and converging on related logistical methods: Temu is shifting vendor stock to American warehouses to scale back delivery occasions; Amazon is planning to launch a devoted low cost part with merchandise that ship from abroad in a few week.

Within the broadest sense, that is fairly acquainted stuff. Completely different shops providing among the similar merchandise at completely different costs with completely different ranges of comfort is the story of big-box bodily retail and grocery shops, too. However that is completely different in some methods which are apparent and others which are extra refined. These aren’t chain shops providing occasional reductions on branded merchandise with MSRPs, however reasonably marketplaces stuffed with sellers who’re individually pricing nameless merchandise based mostly on fluctuations in warehousing charges, delivery, and the cuts taken by the e-commerce platforms. Moreover, the merchandise we’re speaking about vary from junk to stable unbranded alternate options — that is, throughout the board, low cost purchasing. You would possibly rating a 90 % low cost on a fast-fashion shirt or some dwelling decor dupes, however you’re not going to get a surprising Temu deal on, say, a PlayStation, though you can purchase them there, which wasn’t actually true when it first launched.

These firms are approaching the identical e-commerce technique from very completely different positions as effectively. Temu, a world subsidiary of e-commerce large Pinduoduo, is spending closely to interrupt into international markets together with the US, in lots of circumstances subsidizing delivery and costs and reportedly working at a huge loss; AliExpress has been making slower inroads with its product, which is extra overtly a cross-border whole-adjacent market, with lengthy delivery occasions and minimal home advertising.

Amazon’s drift into cross-border e-commerce predates the likes of Temu and these different opponents. Because the late 2010s, a majority of Amazon’s gross sales have been attributable to third-party sellers, lots of whom pay substantial charges to the corporate for logistical help (warehousing, delivery) and promoting. This technique has been nice for Amazon in numerous methods: it shifts market analysis and threat to sellers; reasonably than stocking their very own merchandise, the corporate fees sellers to inventory theirs; the corporate is now the third-largest participant in digital advertisements, behind Meta and Google, owing largely to charges it fees Amazon sellers to be seen on Amazon. It’s additionally modified the product in additional difficult methods. American sellers, lots of whom sourced or manufactured their merchandise abroad, quickly discovered themselves competing with sellers with extra direct connections with Chinese language factories; Amazon, for its half, courted abroad sellers. American sellers have been made to seem like middlemen, which in some methods they have been — the businesses they have been constructing have been much less manufacturers than high-ranked-and-reviewed Amazon listings, and the producers they labored with knew precisely what sorts of margins they have been getting.

Now, one thing related is occurring to Amazon as a complete. Whereas the platform has been shifting downmarket, turning into extra hostile to call manufacturers whose merchandise are being undercut and in some circumstances plainly ripped off, China-based opponents are attacking it from under, working with among the similar producers and sellers to forged Amazon because the intermediary with needlessly excessive costs. Whereas Amazon initially pushed into cross-border e-commerce by itself phrases, now it’s doing so defensively.

Amazon nonetheless has big benefits right here. It’s worthwhile, broadly appreciated and trusted, and nonetheless utilized by tens of tens of millions of Individuals to purchase mainstream merchandise from recognizable manufacturers. Prospects who use it to purchase an occasional CUPSHE gown, on which Amazon and a third-party vendor are accumulating big margins, are more likely to be shopping for batteries or detergent, too. And no firm, international or home, can come near Amazon’s Prime delivery infrastructure.

However there are apparent dangers, too. Prospects like low-cost issues, however they like cheaper issues extra. It’s not clear that Amazon can profitably win in a race to the underside, or that it received’t injury its popularity attempting. Amazon dangers making its market absolutely uninhabitable for extra established manufacturers, and hostile to home sellers, a few of whom have known as its Temu-ish plans a “slap within the face.”

Then there are clients. An ornate nine-dollar gown on AliExpress is an moral and environmental nightmare, a semi-disposable garment of sewn-together externalities. However so is the one on Amazon — which can be one thing worse, a minimum of within the eyes of {the marketplace}: a extremely dangerous deal.