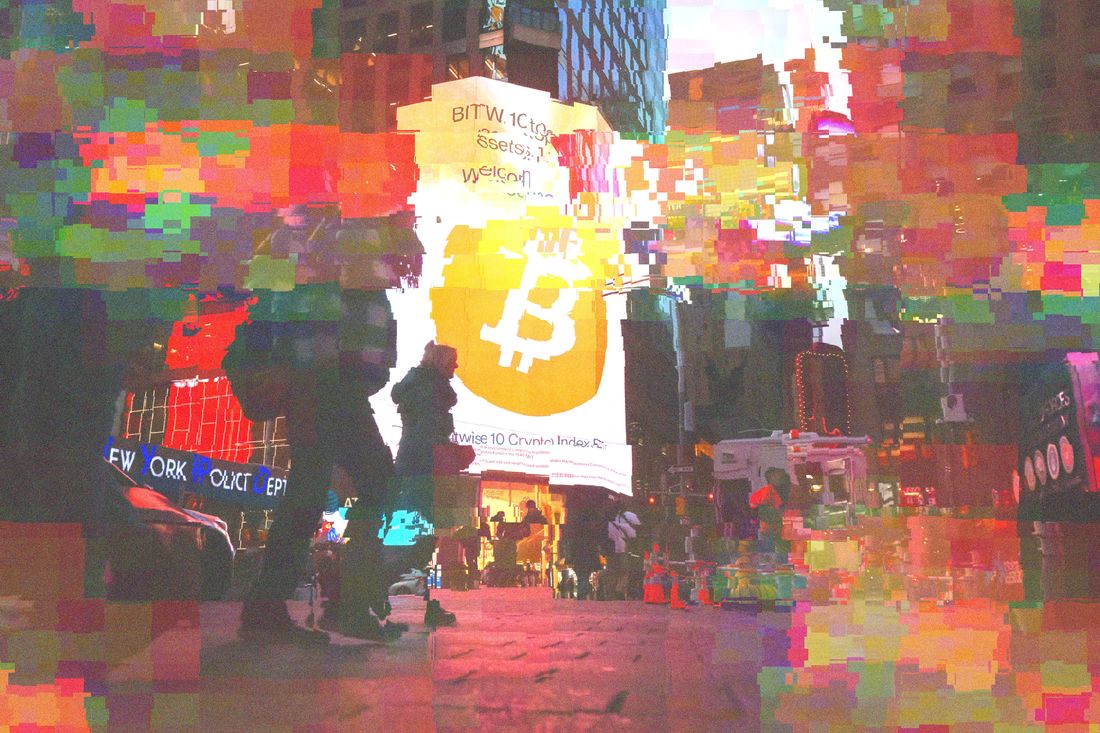

Photograph-Illustration: Intelligencer; Photograph: Getty Photographs

Round Election Day, 2024, the worth of bitcoin began an extended, steep climb. Already priced close to its all-time excessive, and pushed partially by the approaching arrival of an especially pro-crypto administration, a bitcoin value round $70,000 was, by October of 2025, at greater than $126,000. That, in the meanwhile, was the highest: By Thanksgiving, it was again close to $90,000 earlier than briefly stabilizing. This week, within the context of a broader plunge in tech shares and commodities, it almost touched $60,000.

Longtime bitcoin holders will appropriately level out that swings like this include the territory and have loads of latest precedent. In early 2018, bitcoin costs fell by greater than half; when you had been late to the COVID crypto increase, shopping for on the prime and panic-selling on the backside, you may need misplaced 75 % of your cash. They may additionally level out that, ten years in the past, bitcoin was priced within the low a whole bunch.

I received’t faux to know the place we’re on this cycle or what the longer term holds for bitcoin. However amongst crypto watchers, it does appear there’s an rising sense that this crash is completely different. Within the early 2010s, crypto was a curiosity; by the early 2020s, it was a multitrillion-dollar phenomenon that had emerged from exterior of conventional finance. Now, each politically and mechanically, it’s a part of the system. Credible estimates put crypto possession at round 14 % of U.S. adults in 2025, with that quantity reaching 25 % amongst males ages 18 to 49. Run-ups have a tendency to draw extra individuals to crypto, so the numbers now are nearly definitely larger.

That’s lots of people feeling the ache proper now, and so they’re doing so in a modified atmosphere. Early crypto traders discovered each other on boards, counseling each other on whether or not to promote — by no means! — between discussions concerning the philosophy and potential futures of digital foreign money. As crypto went extra mainstream, its tradition grew to embody mercenary gamblers and traders, who understood it when it comes to danger, upside, bets, and trades. The 2020s re-narrativized crypto as a instrument to remake the web, the monetary system, and just about the rest — this was the period of Web3 and the crypto-adjacent metaverse — marshaling the storytelling sources of Silicon Valley within the course of. Whereas the worth of Bitcoin, if not most different cryptocurrencies, greater than recovered after the next hunch — and helped the crypto foyer develop into an enormous lobbying pressure — the blockchain-everything story by no means fairly did, a minimum of with the general public, and was changed the following time round by a risky political story, rendered crudely as Trump loves crypto — go go go.

Now, Bitcoin traders trying to each other for consolation, or for novel and compelling counternarratives and a recent, forward-looking thesis, aren’t getting a lot. As Joe Weisenthal at Bloomberg observed:

There’s probably not a crypto presence on social media nowadays. Sure, after all, there’s nonetheless tons of scammers on the market that may spam your replies, however there’s probably not a web based Bitcoin (and even Ethereum) group like there was a couple of years in the past. Possibly it’s some change to the X algorithm or one thing like that, however that complete scene has actually hollowed out. No one’s round to console one another.

It’s true: Look across the elements of social media the place crypto’s narrative restoration would have beforehand taken place, and also you’ll see a bunch of individuals — lots of the identical individuals — speaking about AI. For many different investments, this won’t sound like a very powerful factor. For another foreign money which you can’t actually use as cash — and that has drawn new holders with an especially big selection of compelling, typically tenuous, and infrequently conflicting tales about why it needs to be extra invaluable — it issues rather a lot.

Amongst these counternarratives is the case for bitcoin as a hedge towards foreign money debasement, suggesting it needs to be having a second; as an alternative, it’s shifting alongside tech shares. As with tech shares, individuals with no direct curiosity in crypto are additionally uncovered, now that public pension funds are invested in bitcoin treasury corporations, for instance, whose shares have collapsed. And lately, a widening pool of traders has wager on crypto by way of ETFs, which they’ll purchase by way of conventional brokerage accounts, and which include the imprimatur of main monetary establishments. (An August government order signed by Donald Trump, titled “Democratizing Entry to Various Belongings for 401(okay) Traders,” ordered regulators to determine find out how to get crypto, together with different nontraditional belongings, into 401(okay)s. Whereas that hasn’t but come to go, the truth that it didn’t assist maintain crypto costs up is, as they are saying, bearish.)

It’s the primary actual crypto crash: One other basically hard-to-explain swing in a speculative asset, positive, but additionally a sudden dip in an institutionally and culturally legitimized funding that impacts thousands and thousands of individuals immediately — and not directly — as part of the actual economic system. Bitcoin isn’t an escape from the system. It’s a part of it, now, and so is its danger.